MarketWatch.com:

The Federal Reserve every quarter produces what’s called the financial accounts of the U.S., and on Thursday, the central bank released the latest edition, which is 205 pages of dense statistics on the assets and liabilities of households, businesses and governments.

James Knightley, chief international economist at ING, put a positive spin on the latest report. From the low point of the first quarter of 2020, household wealth has surged by $35.5 trillion. Combine this wealth rise with employment growth, and wage gains, and the U.S. consumer looks to be in good shape. The “further massive accumulation of wealth only adds to the potential spending ammunition of the household sector, which gives us more confidence that the U.S. economy can expand by more than 4% in 2022,” says Knightley.

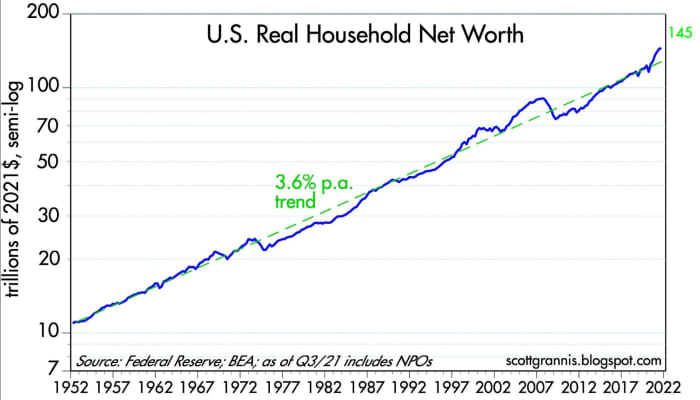

Scott Grannis, author of the Calafia Beach Pundit blog and former chief economist for Western Asset Management, had a different interpretation. He pointed out that while liabilities of households have grown 21% from their 2008 peak, net worth has more than tripled. After adjusting for inflation, household net worth has increased 11 fold over the past 70 years.

Another way to look at it — adjusting for inflation and population growth, net worth per capita has soared from $72,000 to $432,000 over the last 70 years.

Both charts, he noted, are running ahead of their long-term trend line. “This could be a replay of what we saw in 2000 and 2007, when some markets got very overextended. By that I mean that for the next several years a mere reversion to trend would mean very modest returns for investors,” he said.

Those low returns could materialize from inflation. “It would not be surprising to see net worth fall below its long-term trend, as it did during the high-inflation 1970s,” he said. With inflation running at 7%, the average interest rate on federal debt at about 2%, the real value of federal debt is falling by about 5% a year.

“In other words, inflation is subtracting over $1 trillion of the real value of federal debt outstanding every year at the same time inflation is boosting government revenues and nominal GDP. This means that the private sector is effectively paying an additional $1 trillion per year in taxes to the federal government (aka the inflation tax),” he said.

READ MORE at MarketWatch.com