Marketwatch.com:

Shares of Support.com rocketed on heavy volume again on Friday, and have now run up more than fivefold in a little over a week, even as the customer and technical support services company has not released any news.

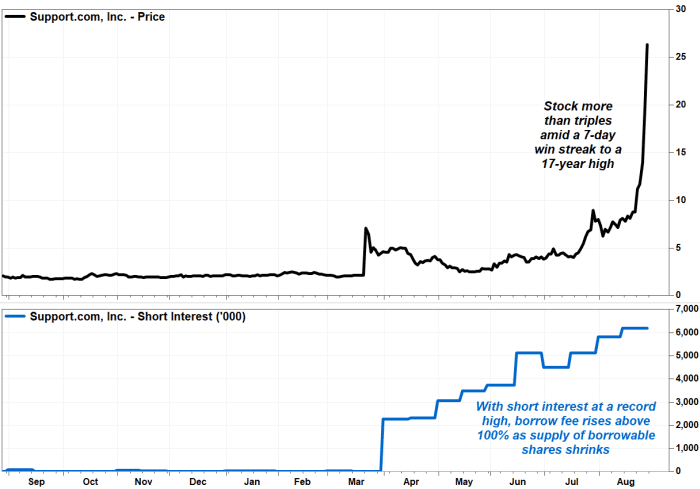

The stock SPRT, 59.48% rose as much as 203% in intraday trading, before pulling back to close Friday up 33.7% at $26.33, the highest closing price since October 2004. Trading volume ballooned to 162.3 million shares, enough to make the stock the most actively traded on major U.S. exchanges.

The so-called meme stock has now run up 223.5% amid a seven-day win streak, which included Thursday’s 41.1% rally on volume of 105.9 million shares.

The rally appeared set to continue on Monday, as the stock shot up 40.3% in premarket trading. An eighth-straight gain would match the eight-day streak that ended July 28.

Earlier this year, Support.com shares garnered significant attention by blasting a record 231.8% higher on record volume of 282.6 million shares, after the company announced a deal to be acquired by bitcoin mining company Greenidge Generation Holdings Inc., in a deal that was expected at the time to close during the third quarter of 2021.

Meanwhile, the stock’s current rally has occurred with no news released by the company, and nothing filed with the Securities and Exchange Commission.

The company has not responded to a request for information and/or comment.

Still, Support.com is getting plenty of attention from the retail crowd, as it is the top trending stock on StockTwits and “hot” among the Reddit crowd.

The rally also comes at a time bearish bets against the stock have spiked in recent months to multiples of the previous record.

Short interest has reached 6.18 million shares as of mid-August, according to the latest exchange data, or about 193 times the short interest (32,037 shares) at the end of 2020.

The previous record for short interest, prior to 2021, was a split-adjusted 425,838 shares in July 2008.

With a public float of 9.29 million share, short interest as a percent of the float is roughly 66%, “which is pretty high,” according to Fintel.io Founder Wilton Risenhoover.

For example, short interest as a percent of float for fellow meme stock AMC Entertainment Holdings Inc. AMC, 1.59% was about 18% as per the latest data, and for GameStop Corp. GME, 0.55% was about 12%.

And despite the stock’s rocket ride higher, interest to bet on a decline has increased, as bears are willing to pay up to short the stock.

“The borrow fee rate is up to 102% and climbing this morning,” Risenhoover told MarketWatch. He added that Interactive Brokers reported zero shares available to borrow.

A week earlier, Fintel indicated that the borrow fee rate was about 86%, making the stock the equity research platform’s fourth most likely, at that time, to experience a “short squeeze,” or a rapid covering of bearish bets that leads to higher stock prices.

Support.com’s stock has now soared 1,096.8% year to date, while the S&P 500 index SPX, 0.16% has gained 20.1%.

READ MORE at Marketwatch.com