Marketwatch.com:

Following back-to-back records on Wall Street, the summer doldrums seem on tap for Thursday, with the week’s big inflation data now tucked away.

Those highs come as investors veer toward the perceived safety of defensive stocks, concerned that the highly contagious delta variant of COVID-19 will curb economic activity. The Nasdaq Composite is trailing the Dow DJIA, 0.04% and S&P 500 SPX, 0.30% for the week and month.

They may be cautious for now, but the herd may be about to turn, says our call of the day from a team of Citi analysts led by Hong Li.

“With the 10-year yield TMUBMUSD10Y, 1.369% expected to recover to 2% by the end of the year, according to our U.S. rates strategy team, we do not think that the cautious rotation can be sustained much longer and expect crowds to move toward more economic-sensitive sectors and value to outperform again,” said Li and the team. That yield inched toward 1.8% this year before backing off, but has been creeping up again in recent weeks.

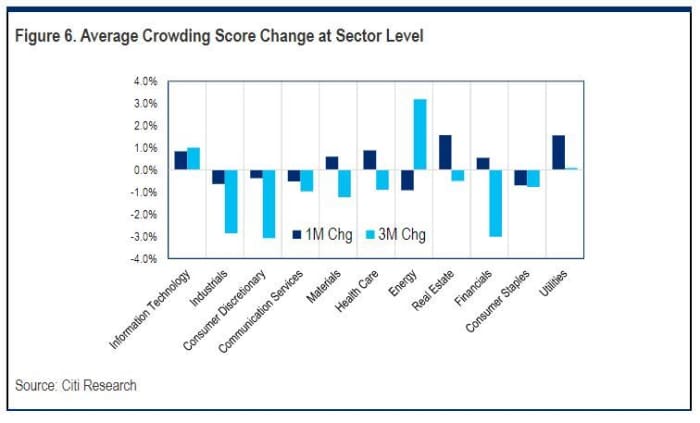

Citi analysts say technology,, led by semiconductor and software stocks, remains the most crowded sector, even if performance has been so-so lately, while utilities and consumer staples continue to be the least crowded, despite an outperformance in July.

“Conventional thinking is to avoid buying crowded stocks (high crowding composite), as they may become harder to attract marginal investors, while stocks that are less crowded are prone to react more positively to fundamental catalysts, as they can attract a larger set of new investors,” said the Citi team. But they caution that the crowding composite is just one of many factors that should be considered when making an investment.

As for which stocks have seen the least crowding, AT&T T, -0.57%, Gilead Sciences GILD, +1.49%, Dollar Tree DLTR, -0.86%, Kellogg K, -0.05% and Edison International EIX, -0.02% are the top five . The most crowded bunch includes Adobe Systems ADBE, +1.33%, Nike NKE, -0.44%, Thermo Fisher Scientific TMO, +0.83%, Snap SNAP, -1.66% and Zoetis ZTS, +1.11% at the top.

The markets

Stocks DJIA, 0.04% SPX, 0.30% COMP, +3.85% are mixed after a batch of data, while Europe equities SXXP, +0.11% are just hanging onto a record streak of gains. Asian stocks were in the red, with China’s CSI 300 000300, -0.84% down 0.8% amid those prospects for more regulation. Oil prices CL00, -0.48% BRN00, -0.20% are slipping after the International Energy Agency and the Organization of the Petroleum Exporting Countries expressed worries over demand growth.

U.S. initial jobless claims dipped 12,000 in the latest week, while producer prices for July rose a bigger-than-expected 1%.

Shares of Baidu BIDU, -3.23% are slipping after the Chinese multinational technology group beat on profit and revenue, but its outlook disappointed. And Nio NIO, -3.46% is up after the U.S.-listed Chinese electric-car maker reported a narrower-than-expected quarterly loss. Results from Mouse House Disney DIS, +0.75% and online lodging marketplace Airbnb ABNB, +2.02% are due after the close.

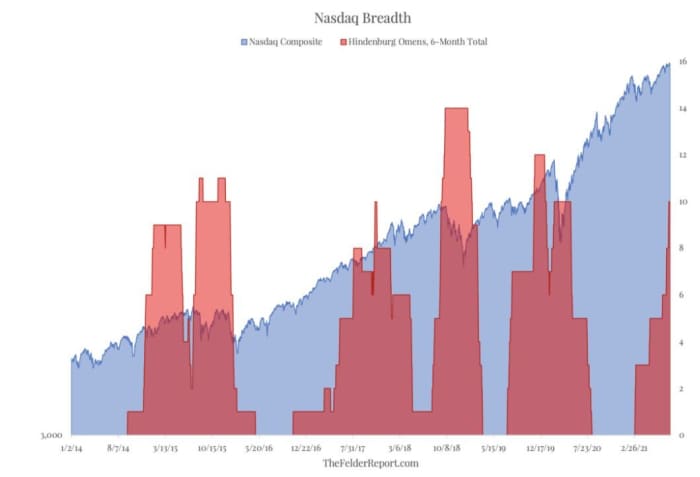

Where there’s fire, there’s at least a warning signal, according to our chart of the day, from Jesse Felder of The Felder Report. In February of 2020, as stocks pushed to new highs, he noted several Hindenburg Omens had been triggered on U.S. stocks that pointed to a sharp deterioration in breadth — when the number of declining equities outpaces advancing.

Named after the 1937 German airship disaster, the Hindenburg Omen is a technical indicator that warns of market crashes. As Felder’s below chart shows, after February’s warning came the pandemic pullback.

What’s happening now? Over the past six months, 10 Hindenburg Omens have triggered on the Nasdaq, “a level that has particularly warned of significant stock market turbulence ahead,” writes Felder, who adds that now might not be a bad time to do a gut check on individual risk tolerance.

READ MORE at Marketwatch.com